|

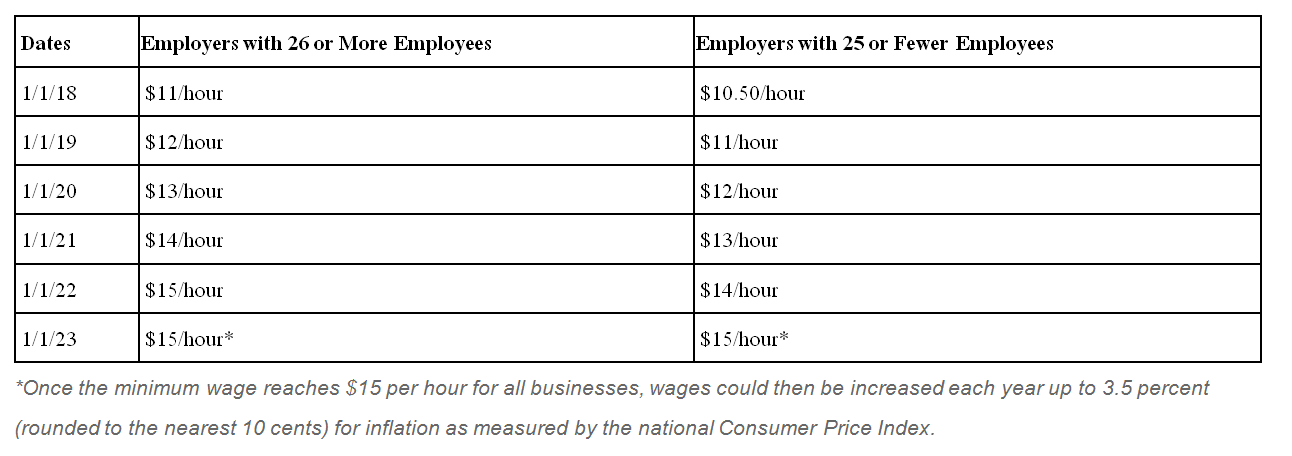

Wage and hour changes are on the horizon once again. In 2016, Governor Edmund G. Brown Jr. signed SB 3, making California the first state in the nation that committed to raising the minimum wage to $15 per hour statewide. Under the bill, California’s minimum wage increases annually so it hits $15 per hour for all businesses by 2023. Large businesses with 26 or more employees began complying on January 1, 2017, and will reach $15 per hour in 2022. The increase in 2018 for large businesses is 50 cents — from the current rate of $10.50 per hour to the new rate of $11 per hour. Small businesses with 25 or fewer employees had a one-year delay; they will see their first increase on January 1, 2018, and will have until 2023 to reach the $15 per hour rate. The increase in 2018 for small businesses is from the current rate of $10 per hour to the new rate of $10.50 per hour. In the midst of all the statewide changes, various localities throughout California continue to pass their own ordinances that will affect how employees are paid. Employers should start preparing for these changes by examining all pay practices that may be affected. Minimum Wage The staggered minimum wage increases over the next several years are as follows: California employers must pay employees no less than the state minimum wage per hour for all hours worked.

When laws differ, employers must comply with the more restrictive requirement — in other words, the requirement that gives the biggest benefit to the employee. Since California’s state minimum wage is higher than the federal minimum wage of $7.25 per hour, most employers will be required to pay that rate. As mentioned above and discussed further below, local ordinances may also come into play. The obligation to pay the state minimum wage can’t be waived by any agreement, including a collective bargaining agreement. Remember that a top priority for state enforcement agencies is to stop employers from engaging in so-called “wage theft,” which includes not paying the minimum wage for all hours worked. The minimum wage increase affects not only your nonexempt minimum wage workers, but also has other ramifications, such as exempt/nonexempt classification and posters and notice requirements, discussed below. Preparation, as always, is key. Overtime Rate The minimum wage rate change also affects overtime pay. Effective January 1, 2018, the overtime rate for minimum wage employees increases but varies depending on whether you’re a large or small business:

Classifying Employees Exempt/nonexempt classification is always a tricky issue, as employers must ensure that employees meet the salary basis test for the particular exemption claimed. For an employee to meet a “white collar” exemption from overtime (the commonly used administrative, executive or professional exemptions), California law states that the employee must earn a minimum monthly salary of no less than two times the state minimum wage for full-time employment, in addition to meeting all other legal requirements for the exemption. Effective January 1, 2018:

Future increases will also affect the salary threshold. Also, certain commissioned inside sales employees can be eligible for an overtime exemption under Wage Order 4 and Wage Order 7. Generally, the exemption applies if the employee earns more than 1.5 times the minimum wage and more than half of the employee’s compensation represents commission earnings. Employers will need to make sure that commissioned inside sales employees continue to meet this test after the January 1 minimum wage increase. Outside salespeople do not need to meet the minimum salary requirements. Misclassification is costly. Employers who are unsure whether their employees ought to be exempt or nonexempt should always check with their legal counsel. Posters and Notice Requirements The minimum wage rate change affects notice requirements for the minimum wage posting, itemized wage statements and wage notices. First, all California employers must post the state’s official Minimum Wage Order (MW-2017) in a conspicuous location frequented by employees. The official notice includes the increase for both 2017 and 2018. Second, California employers must provide each employee with an itemized statement, in writing, at the time wages are paid (Labor Code Section 226). Among other mandatory information, the itemized wage statement must include all applicable hourly rates in effect during the pay period and the corresponding number of hours the employee worked at each hourly rate. Itemized wage statements will need to reflect any increased wages. Finally, employers in California must provide nonexempt employees with a wage notice pursuant to Labor Code Section 2810.5. The written notice must be provided at the time of hire and again within seven calendar days after any information in the notice is changed. Among other things, employers are required to notify nonexempt employees, in writing, when there is any change to:

NOTE: If an employee’s rate of pay will increase on January 1, 2018, due to the state minimum wage increase, the employee must receive notice from his/her employer by January 7, 2018. However, if the employer has reflected the change on a timely itemized wage statement and the statement meets all legal requirements, the separate wage notice is not required. Meals and Lodging Most of California’s Wage Orders allow employers to credit meals and lodging furnished by the employer toward the employer’s minimum wage obligation (Section 10 of the Wage Orders). The 2018 credit amounts for meals and lodging are listed on the official MW-2017. Piece-Rate Employees The minimum wage increase also affects piece-rate employees. Piece-rate workers must receive at least the minimum wage for each hour worked. A law that took effect in 2016 requires payment of rest and recovery periods or other non-productive time at specified hourly rates. Employers with piece-rate compensation systems need to ensure they are complying with the new minimum wage standard. Draws Against Commissions A commissioned employee may receive a sum of money that is intended as an advance, draw or guarantee against the employee’s expected commission earnings. In California, employers must pay these sums at least twice per month. If an employee receives a draw against commissions to be earned at a future date, the “draw” must be equal to at least the minimum wage and overtime due to the employee for each pay period (unless the employee is exempt). Employers with commissioned employees should make certain that any draw against future commissions uses the new minimum wage rate as a basis. Tools or Equipment When an employer requires that employees use certain tools or equipment, or when the tools or equipment are necessary for an employee to perform the job, the employer must provide and maintain the tools or equipment. There is an exception, however, for employees whose wages are at least two times the minimum wage; they can be required to provide and maintain their own hand tools and equipment customarily required by the trade or craft in which they work. If you require employees to provide and maintain their own hand tools and equipment, make sure that the employees earn at least two times the minimum wage rate in effect. Subminimum Wage There is no distinction between adults and minors when paying the minimum wage. A limited exception exists for “learners,” but that exception does not depend on a person’s age. “Learners” are employees who have no previous similar or related experience in the occupation. California’s Wage Orders permit you to pay learners 85 percent of the minimum wage, rounded to the nearest nickel. State law allows the subminimum wage to be paid for only the first 160 hours of work, after which the employee must be paid at least minimum wage. The subminimum wage rate will increase to $9.35 per hour effective January 1, 2018, for employers with 26 or more employees. It will increase to $8.93 per hour for employers with 25 or fewer employees. Federal and state laws provide different definitions of learners. California employers must be careful to comply with both federal and state subminimum wage requirements and give employees the benefit of whichever law is more favorable to the employees. If you use the “learner” rate, ensure that you follow the strict guidelines for when you can pay the lower rate and use the appropriate rate calculation beginning January 1. Keep accurate records of time worked and do not pay the subminimum wage after the employee reaches 160 hours of work. Local Minimum Wage Ordinances Keep in mind that some cities and counties in California adopted their own local minimum wage rates that may exceed the state rate. This is part of a growing trend in which several cities are enacting local ordinances. If you’re covered by a local ordinance with a higher minimum wage rate, you will have to pay that rate to employees. In addition, if you are covered by a local minimum wage ordinance, you must make sure to post the current local ordinance poster. Best Practices for California Employers

Comments are closed.

|

|

Copyright © 2024 West Ventura County Business Alliance. All Rights Reserved.

1901 Solar Drive, Suite 105 | Oxnard, CA 93036 Phone: (805) 738-9100 | [email protected] Site Map |